DPR Token

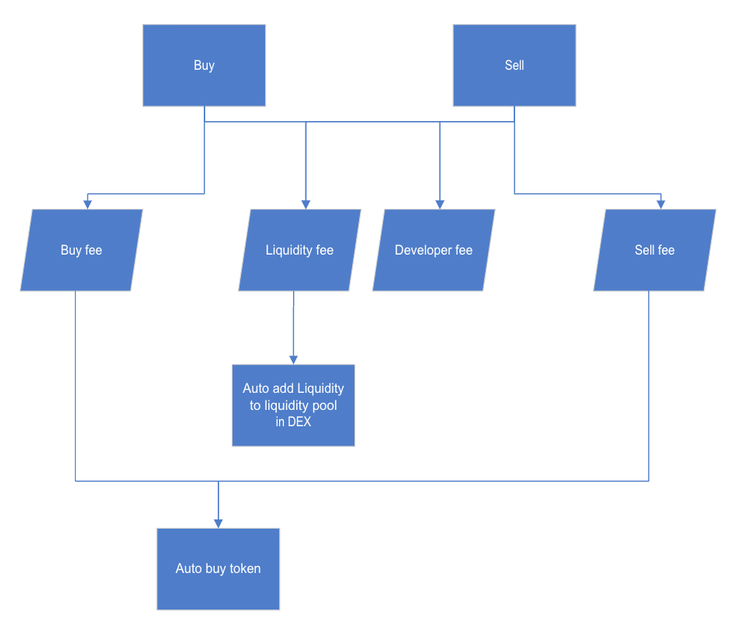

DPR is a token that auto yields and generates liquidity collected from anyone who buys and sells the token. This means that every time someone buys and sells a DPR token, a fee is collected automatically and dispersed to the holders.

Exchange: Sushi Swap

Contract Address: 0x73Fed59E116AE579D9D6C3796D66ACFec39C7AC5

Blockchain: Polygon

What is being collected?

Reflection buy fee, Reflection Sell fee, Liquidity fee and Developer fee.

Reflection buy and sell fee are being collected to buy the tokens and redistributed to all the holders. 1%

Liquidity fee is being collected to put on the liquidity of the token. 1%

Developer fee is being collected by the developer team. 1%

Reflection fee:

A Reflection fee is a type of cryptocurrency token with a unique tokenomics model designed to reward holders automatically. Here are the key characteristics:

Core Mechanism:

- Reflection tokens automatically redistribute a percentage of transaction fees to existing token holders

- Every time a transaction occurs (buy or sell), a portion of the transaction is automatically split and redistributed

- Holders receive additional tokens simply by holding the cryptocurrency in their wallet

How Reflection Works:

- When someone buys or sells the token, a small percentage is automatically distributed

- The distributed amount is proportional to the number of tokens each holder owns

- This happens without requiring manual claims or staking

- The redistribution occurs instantly and transparently through smart contract programming

Key Features:

- Passive income generation for token holders

- Encourages long-term holding

- Creates a built-in reward system within the token’s ecosystem

- Potentially reduces selling pressure by incentivizing holding

Potential Risks:

- Complex tokenomics can be difficult to understand

- Not all reflection tokens perform consistently

- Potential regulatory scrutiny

- Market volatility can significantly impact token value

- Smart contract vulnerabilities

Liquidity Fee:

- A fee charged during token transactions to support the token’s liquidity pool

- Typically a small percentage of each buy or sell transaction

- Automatically collected and used to maintain or enhance the token’s market functionality

Purpose of Liquidity Fees:

Pool Maintenance

- Helps sustain the token’s liquidity on decentralized exchanges

- Provides funds to keep the trading pair balanced

- Ensures smoother trading experiences with reduced price slippage

Automated Market Making (AMM)

- Fees are often redirected to liquidity providers

- Incentivizes individuals to contribute to the token’s trading ecosystem

- Helps maintain stable trading conditions

Important Caution:

As with any cryptocurrency investment, thorough research and consultation with a financial advisor are crucial before making any investment decisions.